pay indiana state tax warrant

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. Under Indiana Code 35-33-5-7 Indiana search warrants must be.

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

Have more time to file my taxes and I think I will owe the Department.

. These should not be confused with county tax sales or a federal tax lien. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC.

1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail. Take the renters deduction. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check.

If you have unpaid taxes and have received notification of a tax. However circuit clerks using the INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax. Was this article helpful.

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. If you receive a written Tax Warrant follow these. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

There are three stages of collection of back Indiana taxes. Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and expunging the tax warrant may be in the best interest of the. Served within ten days from the issuing date.

If your account falls into the collection process it is important to understand each billing stage and its deadline. Search by address Search by parcel number. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Our service is available 24 hours a day 7 days a week from any location. If an officer fails to execute the warrant correctly it may become invalid. Last updated on Fri Mar 31 165927 EDT.

Law officers must execute Indiana search warrants according to the directions of the issuing court. Pay my tax bill in installments. LLC to take Indiana to the next level in state tax administration.

Tax Warrant Payment Methods. To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue. Know when I will receive my tax refund.

Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. Occasionally it is necessary for the Indiana Department of Revenue DOR to issue bills for unpaid taxes. Depending on the amount of tax you owe.

Doxpop provides access to over current and historical tax warrants in Indiana counties. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

Instead this is a chance to make voluntary restitution for taxes owed. A Tax Warrant is not an arrest warrant. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number.

Find Indiana tax forms. Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. Tax Warrant for Collection of Tax.

See Departmental Notice 2 for more information. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. Also called a lien the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes.

Although this is not a warrant for your arrest the information will appear on a credit report or title search and becomes a lien on your property. You should also know the amount due. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

734 out of 1441 found this helpful. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247. Claim a gambling loss on my Indiana return.

Pay my tax bill in installments. 2022 the gasoline use tax rate in Indiana for the period from May 1 2022 to May 31 2022 is 0241 per gallon. Tax Warrants are issued by written letter never by telephone.

Dor How To Make A Payment For Individual State Taxes

Indiana Tax Relief Information Larson Tax Relief

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Dor Owe State Taxes Here Are Your Payment Options

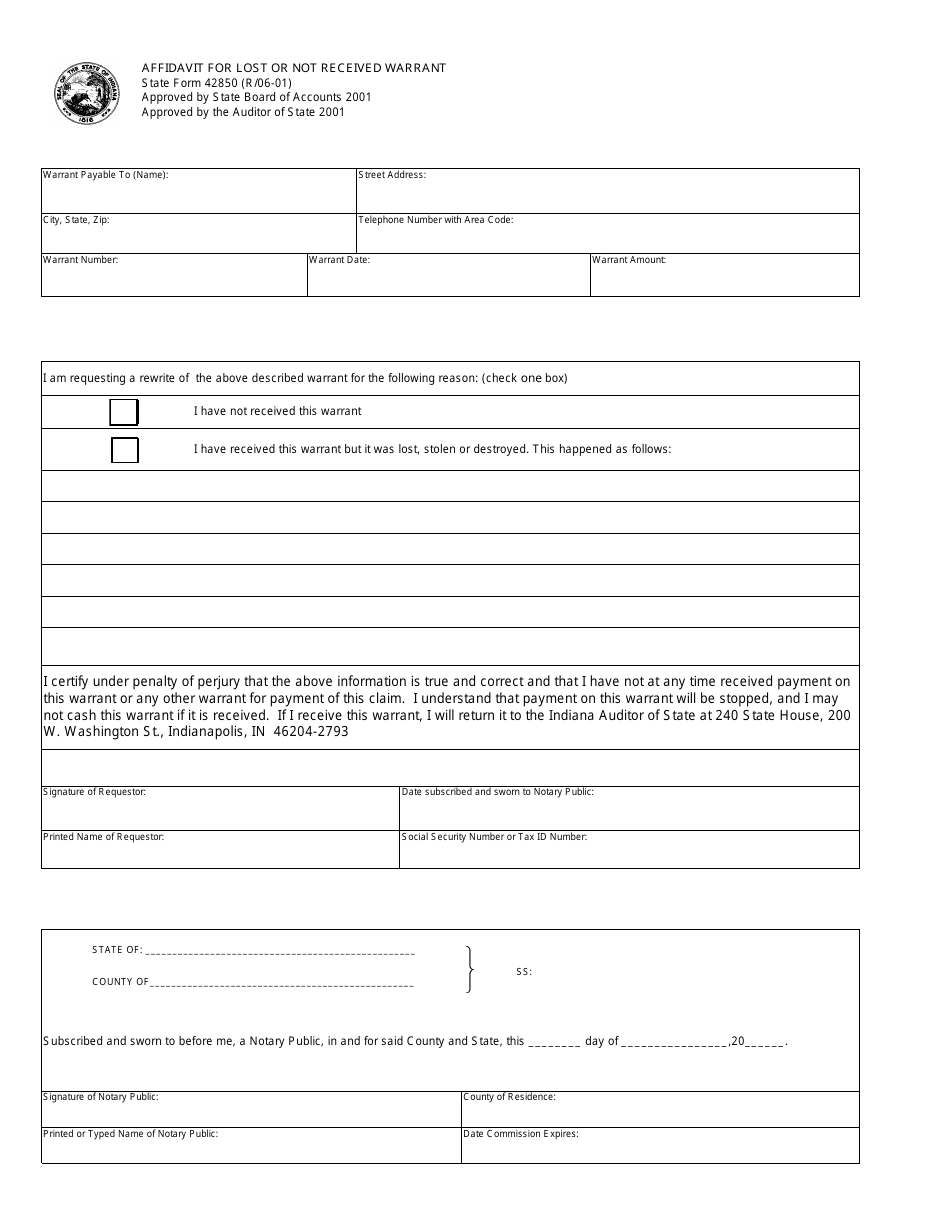

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Greenwood Police Warn Residents Of Tax Scam Fox 59

Dor Make Estimated Tax Payments Electronically

State Form 23037 Download Fillable Pdf Or Fill Online Affidavit Of Ownership For A Vehicle Indiana Templateroller

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Indiana Department Of Revenue Linkedin

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid

Dor Indiana Extends The Individual Filing And Payment Deadline

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

Dor Owe State Taxes Here Are Your Payment Options

Unfortunate But Familiar Indiana Dwd Warns Of Rise In Unemployment Fraud Wane 15